Each year, City staff creates and present an annual budget for the City Council to review and modify. The budget includes expenditures and revenues for the General Fund, Capital Improvement Plan, Debt Service Funds, Enterprise Funds, various Roads funds, and Special Revenue Funds. A preliminary budget is adopted by the Council by the end September each year, which is submitted for certification to Hennepin County. Once submitted, the preliminary levy can be lowered, but not raised. Final budget is approved by the City Council in December each year.

Things to know about the 2023 City Budget:

Like many of us, the Minnetrista City Council prepares a budget each year to pay for essential services such as police and fire protection, park and recreation services, roads, buildings, vehicles, equipment, staff compensation and much more. For 2023, the approved tax levy is $5,854,229, which is a 9.18% net levy increase from 2022.

Below are the contributing factors to the proposed increase:

- Compensation Study Impact: The City Council approved a new Pay Plan after performing a market compensation study in early 2022. This leads to a $205,000 impact on the levy.

- Union Increases: The City Council approves labor agreements with the four unions every three years. The 2023 contract increases have a $75,000 impact on the levy.

- 2022 New Hires: The City Council approved to new hires for mid- 2022, and 2023 will realize the annual impact of these mid year hires. This leads to a $80,000 impact on the levy

- General Operations: When considering some of the cost increases for fuel, gas, and other supply type items, the Council agreed a 2% adjustment for non- salary and benefit items was a conservative way to budget for 2023. This has a $110,000 impact on the levy

- Addressing the use of Fund Balance in 2022 for 2023: For 2022 we are projecting using about $300,000 as part of our 2022 adopted general fund budget.

Final 2023 Budget approved on December 5, 2022

Tax Rate for Residents

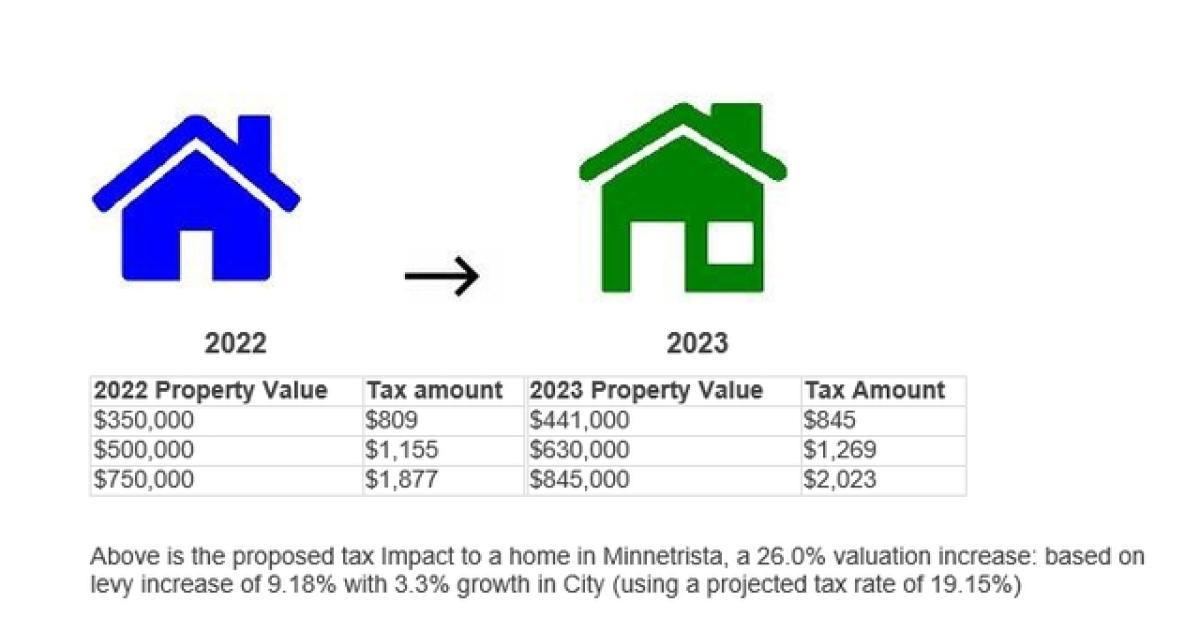

With the housing market sector still performing well, our preliminary numbers from Hennepin County show the City’s tax capacity going up 20%+. This is a from a combination of values on current properties within the City increasing (based on existing sales) as well as new homes/improvements being added in the City. Most of this would be from appreciation on existing properties and about 3.3% would be attributable to new growth. With the increased valuation, (market value/tax capacity) and the above proposed tax levy option presented above, the tax rate would be projected to drop by about 4% from its current 2022 City tax rate of 23.10% to a projected 19.15%.

| Budget Timeline | |

| 8/1/2022 | Initial discussion on proposed 2023 budget and levy |

| 9/6/2022 | Establish Preliminary Tax Levy |

| 9/19/2022 | Water Fund |

| 10/3/2022 | Sewer Fund and Surface/Storm Water |

| 10/17/2022 | Recycling Fund & Cable Fund |

| 11/14/2022 | Park Dedication and Tree Replacement Funds |

| 12/5/2022 | Adopt 2023 Final Budget and Levy/Public Comment |